Golden cross forms in gold's chart as tumble in Treasury yields sends precious metal to 3-week high - MarketWatch

Gold futures on Tuesday finished higher for a fourth straight day, helping the precious metal settle at its highest in about three weeks as U.S. Treasury yields dipped to their lowest levels in weeks and as reports indicated that bullion purchases among central banks was gathering steam.

August gold GCQ21,

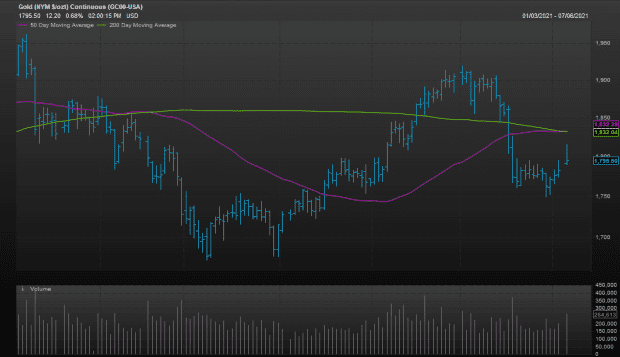

Tuesday's climb was sufficient to propel the precious metal toward a golden cross, which occurs when the 50-day moving average crosses above the 200-DMA, widely viewed as a dividing line between longer-term uptrends and downtrends. The 50-day moving average for gold stood at $1,832.39 an ounce, with the 200-day at $1,832.04, according to FactSet data on Tuesday.

Meanwhile, about one in five global central banks intend to increase their gold reserves over the next year, wrote Bloomberg News, in a report citing a survey conducted by the World Gold Council published last month.

U.S. financial markets were closed Monday in observance of the Fourth of July holiday, Independence Day, which fell on a Sunday this year.

"I think we're seeing gold benefit from a plunge in bond yields," Edward Moya, senior market analyst at Oanda, told MarketWatch. He said that investors, however, may be reassessing their bullish outlook for bullion against a backdrop of Fed that might propel the dollar and yields ultimately higher.

Prices for precious metals were on the rise recently as the price of the U.S. dollar has softened a recent rise and as yields for Treasurys have been in retreat.

On Tuesday, for example, the 10-year Treasury note yield TMUBMUSD10Y,

Lower yields are a boon for bullion because government debt sometimes competes against precious metals as a safe-haven as they don't offer a coupon.

Marios Hadjikyriacos, investment analyst at XM, in a daily research note, warned that "cheap money and a struggling dollar are necessary for gold to flourish," which could come undone as members of the U.S. central bank have been talking more of raising interest rates and tapering other measures of easy-money policies, including monthly asset purchases of $120 billion, by the start of next year.

Meanwhile, silver contracts for September delivery SI00,

Rounding out metals action, October platinum PLV21,

September copper ontract HGU21,

Comments

Post a Comment